By Lea Mira, RTN staff writer - 7.23.2024

PAR Technology Corporation, global restaurant technology leader and provider of unified commerce for enterprise restaurants, has finalized its acquisition of TASK Group, an Australia-based foodservice transaction platform. The deal, valued at $206 million, was initially announced in March 2024 and closed in the third quarter of the same year, following approvals from TASK shareholders, Australian courts, and regulatory bodies.

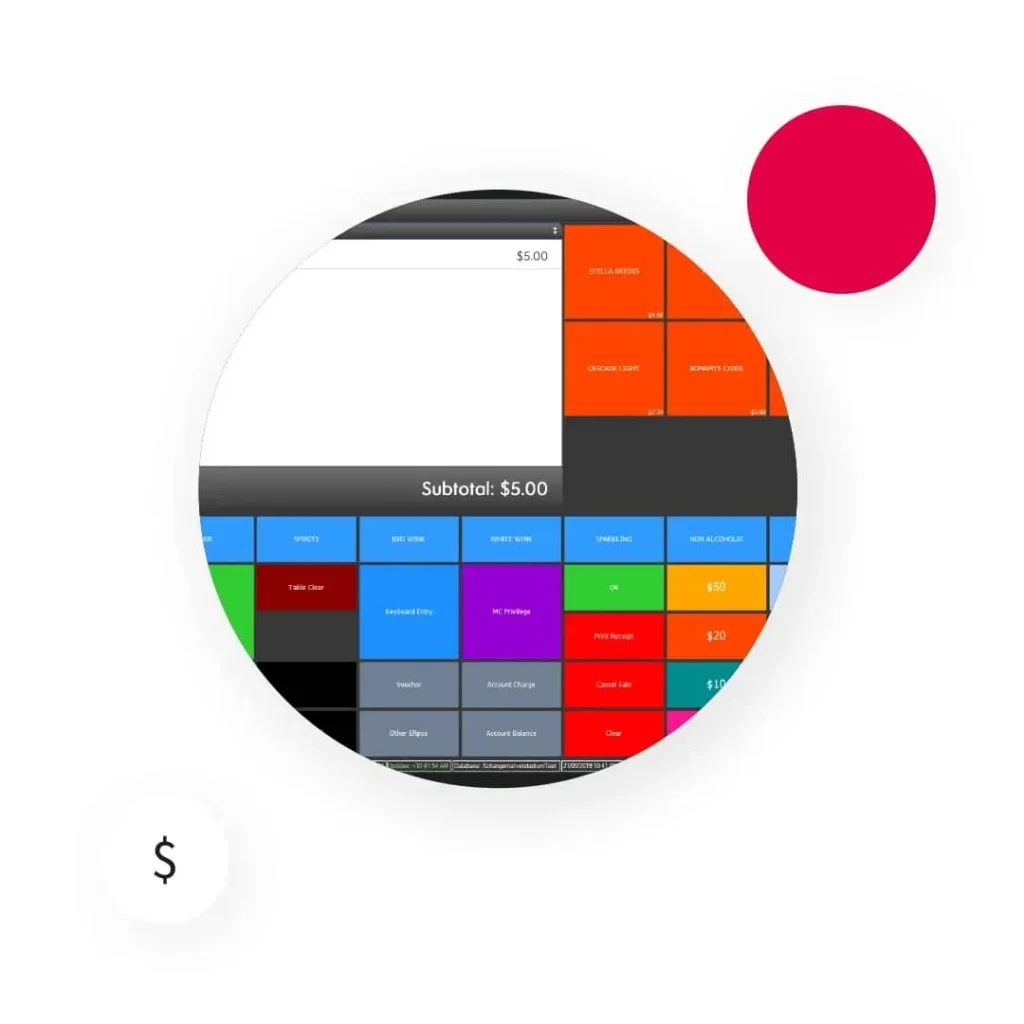

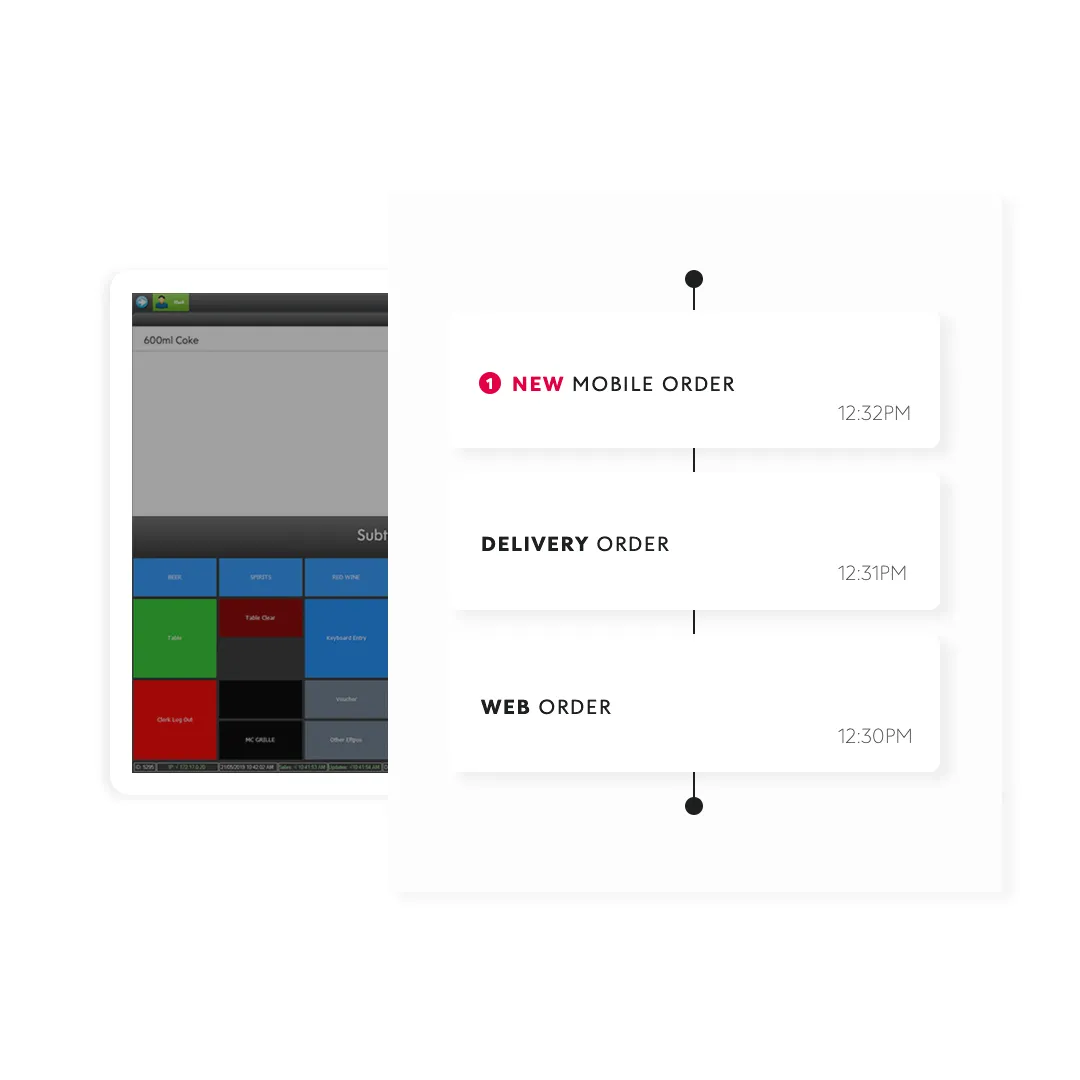

Founded in 2000, TASK identified a need in the hospitality industry for a Point of Sale (POS) system that could effectively manage large deployments across geographically dispersed locations while remaining affordable and user-friendly. The company’s flagship product, a cloud-based POS application with a centralized management suite, addressed this gap by offering real-time sales data, integrated terminal management, and interactive customer engagement tools. This approach attracted major hospitality brands seeking a robust and scalable solution.

Founded in 2000, TASK identified a need in the hospitality industry for a Point of Sale (POS) system that could effectively manage large deployments across geographically dispersed locations while remaining affordable and user-friendly. The company’s flagship product, a cloud-based POS application with a centralized management suite, addressed this gap by offering real-time sales data, integrated terminal management, and interactive customer engagement tools. This approach attracted major hospitality brands seeking a robust and scalable solution.

In 2021, TASK merged with Plexure, a company specializing in customer engagement and loyalty programs. This strategic move aimed to enhance TASK’s existing offerings by integrating Plexure’s expertise in personalized marketing, campaign management, and offer optimization. The merger aimed to provide clients with a comprehensive platform for managing transactions and fostering customer loyalty across multiple channels.

TASK’s platform currently supports leading restaurant brands such as Starbucks, Guzman Y Gomez and McDonald’s, which utilizes TASK’s loyalty platform across 65 markets, enabling these companies to leverage technology for enhanced customer experiences, loyalty building, and global expansion. TASK’s platform is known for its interactive customer engagement tools and seamless integration capabilities.

TASK’s platform currently supports leading restaurant brands such as Starbucks, Guzman Y Gomez and McDonald’s, which utilizes TASK’s loyalty platform across 65 markets, enabling these companies to leverage technology for enhanced customer experiences, loyalty building, and global expansion. TASK’s platform is known for its interactive customer engagement tools and seamless integration capabilities.

This strategic move positions PAR Technology to offer a comprehensive suite of services to prominent restaurants and foodservice brands worldwide. The acquisition aligns with PAR’s stated goal of becoming the leading foodservice technology provider globally. The acquisition involved a payment structure of $131.5 million in cash and the issuance of 2,163,393 shares of PAR Technology common stock.

The integration of TASK is expected to bolster PAR Technology’s unified commerce approach, streamlining operations from front-of-house to back-of-house for enterprise foodservice brands. The combined expertise of both companies aims to create a robust platform that facilitates seamless operations for foodservice companies on a global scale.

This acquisition is part of a larger expansion strategy for PAR Technology, which also includes the acquisition of Stuzo, a digital engagement software provider for convenience and fuel retailers. These strategic moves highlight PAR’s commitment to expanding its market reach, enhancing its product portfolio, and driving sustainable profitability.