By Orit Naomi, RTN staff writer - 5.7.2025

DoorDash has announced its acquisition of restaurant technology company SevenRooms for $1.2 billion, marking one of the largest strategic bets in the hospitality tech sector in recent years. This move signals a deliberate step by DoorDash to broaden its focus beyond food delivery and deepen its involvement in the core operations of the restaurants it serves.

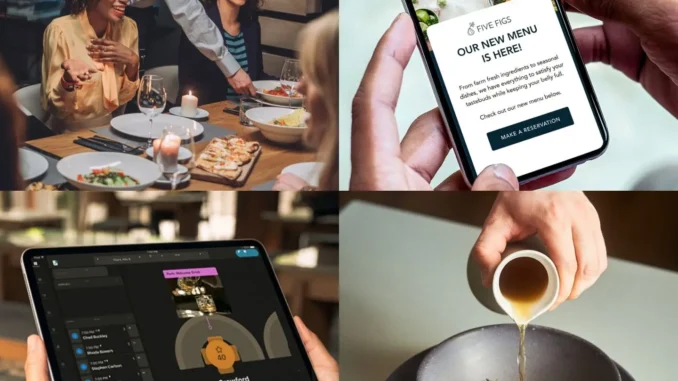

SevenRooms, founded in 2011, has become a well-regarded provider of guest experience and customer relationship management (CRM) tools tailored to the hospitality industry. Its platform includes reservation and waitlist management, automated marketing campaigns, guest profiles, table and seating optimization, and operational analytics. These capabilities are currently in use at thousands of hospitality venues, including major players like MGM Resorts, Mandarin Oriental, and Marriott International. SevenRooms distinguishes itself by prioritizing direct relationships between operators and their guests—an approach that gives restaurants ownership over guest data, enabling better personalization and more efficient loyalty-building strategies.

For DoorDash, the acquisition is not just about adding new software functionality. It reflects a broader ambition to become a comprehensive commerce platform for the restaurant and hospitality industry. Rather than remaining limited to logistics and last-mile delivery, DoorDash is attempting to position itself as a core infrastructure provider—offering technology that supports both digital and on-premises experiences. SevenRooms’ ability to capture in-dining guest behavior and tie it to marketing automation gives DoorDash a way to expand the value it provides to restaurants beyond food ordering and fulfillment.

The financial size of the deal—$1.2 billion—is substantial for a private restaurant technology company, especially in a capital environment that has grown more cautious in recent years. It suggests that DoorDash sees long-term strategic value in owning the tools that facilitate direct-to-consumer relationships, something that complements its own customer-facing delivery infrastructure. SevenRooms has raised just over $75 million in venture funding since its inception, making this a significant exit for the company’s backers. According to multiple sources, the transaction is expected to close in the second half of 2025, subject to regulatory approval and customary closing conditions.

In a related development, DoorDash has also confirmed its acquisition of UK-based food delivery company Deliveroo for approximately $3.9 billion. This strategic move, first announced in April, expands DoorDash’s presence to over 40 countries, reaching a combined population exceeding 1 billion. Deliveroo, founded in 2013 and based in London, operates in nine markets including France, Ireland, and Singapore. This acquisition is expected to enhance DoorDash’s global footprint and competitive positioning in the food delivery market.

The integration of the companies may present both opportunity and risk. DoorDash will need to ensure that SevenRooms retains its existing customer base and brand credibility, especially among full-service restaurants and hospitality groups that may not see themselves as natural partners to a delivery-first platform. Historically, SevenRooms has differentiated itself from competitors like OpenTable, Resy, and Tock by focusing on operator-owned guest data and avoiding third-party marketplace dependencies. Maintaining that positioning under the DoorDash umbrella will be a key challenge—and a potential differentiator if handled carefully.

There are also competitive implications across the broader restaurant tech landscape. While companies like Toast, Olo, and Square have built vertically integrated technology ecosystems spanning POS, online ordering, and payment processing, DoorDash has primarily focused on delivery, driver logistics, and consumer engagement. With this acquisition, it takes a more direct step into in-venue operations, a space that is increasingly shaped by automation, personalization, and real-time data. If integrated effectively, SevenRooms could serve as a foundational layer for DoorDash to offer restaurants more holistic engagement and monetization tools—whether guests are dining in, ordering out, or engaging digitally post-visit.

For restaurants, the implications will likely vary based on service model and scale. Large, high-volume operations—especially in urban areas—may find value in the combined offering’s potential to unify delivery and in-house guest data. However, questions remain about data ownership, pricing, and how the two platforms will be packaged going forward. Independent operators who currently use SevenRooms may be cautious about how the acquisition will affect their ability to control guest interactions and communications.

From a market perspective, the announcement caused some turbulence. DoorDash’s stock dipped slightly following the news, with some investors expressing concern about the pace of the company’s expansion and the challenges of integrating a company with a distinct customer base and product philosophy. However, others see the move as a necessary evolution as competition in delivery continues to tighten and margin pressure increases. By owning more of the restaurant tech stack, DoorDash may be able to reduce churn, increase partner dependence, and unlock new revenue streams that are not tied to per-order commissions.

Ultimately, the acquisition of SevenRooms may be less about a near-term revenue lift and more about strategic positioning. As consumer expectations shift toward more personalized, frictionless hospitality experiences—and as restaurants seek tighter control over their customer relationships—DoorDash is placing a bet on being the infrastructure that powers both the digital and physical dimensions of restaurant commerce.

Whether this bet pays off will depend on how effectively the company manages the integration, whether it can maintain SevenRooms’ trusted position among full-service and luxury hospitality brands, and whether the combined platform can deliver measurable value to operators navigating a still-uncertain economic environment.

As of now, both companies have indicated that SevenRooms will continue to operate under its current leadership, at least in the near term, and that the company’s products will remain available to restaurants regardless of whether they use DoorDash delivery. What happens next will be watched closely by restaurant operators, tech providers, and investors alike, as DoorDash charts a new path at the intersection of food delivery, restaurant operations, and customer experience management.