1.11.2021

A new research report from Paytronix Systems, in collaboration with PYMNTS, highlights how ease-of-use, convenience are the top drivers when consumers make restaurant purchasing decisions. What’s more, even in on-premises situations, restaurants that offer digital first features, like mobile payments, will appeal to key audiences.

The report notes that consumers flocked to multiplatform aggregators during the pandemic and, even as restaurants have opened up, the time savings offered by these platforms remains attractive. The same time and convenience factors drive consumers to look for digital-first features, like mobile payments or ordering via QR code, when visiting their local QSR and table service restaurants.

Among the other key findings:

Multiplatform Users — Since the start of the pandemic, 42% of consumers have used at least one aggregator and 15% have used three or more, acting as “multiplatform users.” Consumers’ ongoing embrace of multiplatform aggregators stems from a desire for simplicity and convenience. Even as consumers have regained access to their favorite restaurants, multiplatform aggregators still provide the kind of time-saving conveniences many consumers, especially affluent younger adults, have come to rely on.

Demographics — Multiplatform users are more likely to be millennials (34%), have high incomes (22% earn more than $100,000 per year) and possess a college education (20%) than the average restaurant consumer. Consumers who do not use aggregators are more likely to be baby boomers and seniors (87%) and have lower incomes (70% earn less than $50K per year).

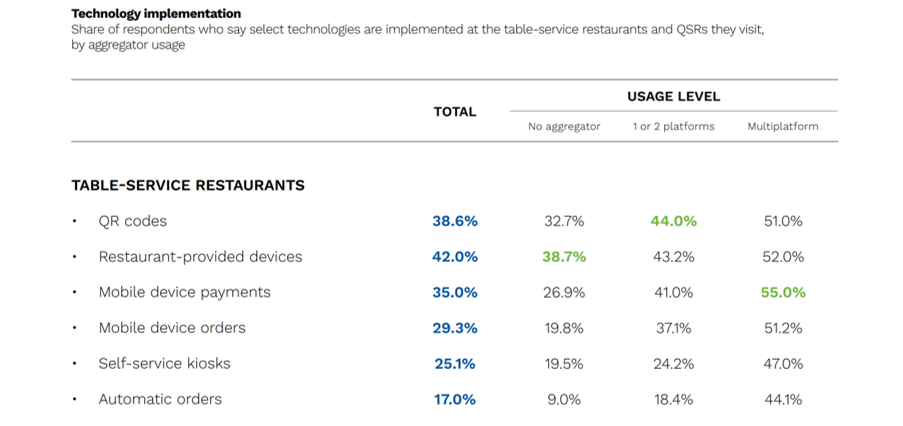

Digital-First Features — Multiplatform aggregator users are digital savants, using available technologies, such as mobile payment and QR code menus, to save time at a rate that is nearly twice that of delivery aggregator nonusers. That means consumers often gain time when they use digital-first tools such as mobile payment apps to make purchases, and this often boosts customer loyalty.

Loyalty Programs Increase — Restaurants have increased their loyalty program offerings, and 48% of consumers are using them. Table-service restaurant customers are slightly more likely to use loyalty programs than those of QSRs (45% and 42%, respectively). This makes sense, as consumers who perceive higher prices when dining in may respond to offers that save them money over time.

Download the full report (registration required): Digital Divide: Delivery Service Aggregators and the Digital Shift