By Alisha Goldberg - 8.7.2019

Restaurant loyalty club members spend an average of $2.14 more than other guests, according to a report on Customer Loyalty Statistics from Businesswire.com and McKinsey Research. What’s more: 82% of loyalty club members referring at least one person while spending an average of 67% more on an annual basis than other guests. The industry average of active loyalty club members for the restaurant sector ranges from 5% to 20% of total transactions.

With such compelling statistics at their fingertips, it’s no wonder that practically every restaurant owner and operator under the sun would want to jump on the loyalty club member bandwagon. And today, of course, that bandwagon is pulled by customer-facing mobile apps.

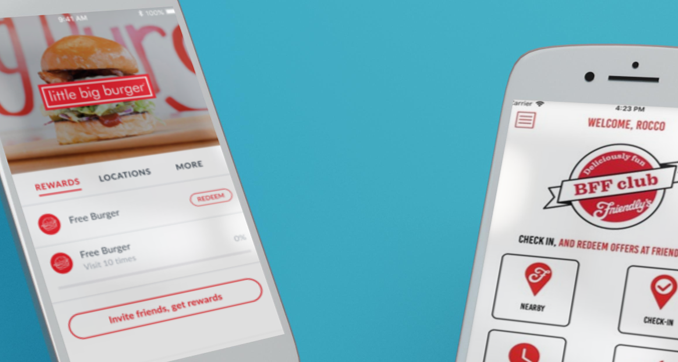

The most recent entrant is Chanticleer Holdings, which owns, operates, and franchises fast, casual, and full-service restaurant brands, including American Burger Company, BGR – Burgers Grilled Right, Little Big Burger, Just Fresh, and Hooters. The company announced last week that its Little Big Burger brand has launched a mobile app and loyalty platform featuring rewards, VIP tiers, and in-app ordering, customized around 8,000 consumer interviews on what they want from a loyalty program.

Utilizing platform capabilities from customer engagement solution provider Thanx, which has worked with hundreds of companies, including major restaurant brands, to help drive incremental revenue through personalized marketing campaigns and deeper customer loyalty, the company expects to now be able to, according to a statement,”move forward with targeted email marketing and integrated customer feedback tools without buying and implementing multiple different technologies.”

With the launch of the new app, Little Big Burger is offering consumers a free burger with the goal of driving 100,000 sign-ups this year. The aim is to reach 15% of its customers with the new loyalty platform. The financial upside certainly makes the effort worthwhile. Assuming that each guest visits the restaurant an average of one time more per month, the company will potential achieve approximately $3.2 million in additional sales and $1.1 million in additional cash flow.

Chanticleer plans to roll out a similar loyalty platform for its BGR – Burgers Grilled Right, American Burger Company and Just Fresh brands, as well, in the coming months.

And what about Hooters? The HootClub, which launched in 2014, continues to grow and build customer loyalty through a multi-channel approach that includes the HootClub mobile app, which tracks purchases. The app includes a Hooters locator and links to the Hooters social channels.

Last year, Chanticleer expanded the program with a big splash when it announced the launch of the first blockchain-based cryptocurrency restaurant rewards program in the United States. The program runs on the MobivityMind commerce platform, paying out HootClub loyalty points in Merits. The company’s stock jumped as much as 50 percent following the announcement.

Meanwhile, other burger joints are upping their mobile app loyalty game. These include small regional chains. Last month, for example, Michigan-based Halo Burger, a 96-year old burger chain, announced the launch of “Halo Rewards,” an upgraded mobile app-enabled loyalty program that rewards guests with special offers and free food exclusively available to Halo Rewards members.

Meanwhile, other burger joints are upping their mobile app loyalty game. These include small regional chains. Last month, for example, Michigan-based Halo Burger, a 96-year old burger chain, announced the launch of “Halo Rewards,” an upgraded mobile app-enabled loyalty program that rewards guests with special offers and free food exclusively available to Halo Rewards members.

These also include large, national chains. For example, Friendly’s Restaurants Also last month announced the launch of its new and improved loyalty program, dubbed the BFF Club. The new BFF Club app boasts several new features, including online ordering as well as expanded functionality to obtain greater rewards.

In additional to the prospect of driving increased sales and revenue, restaurant owners and operators can’t help but get excited about the value of the data collected by app-based loyalty programs. The data generally includes not only purchasing behavior data, but also psychographic and demographic data on customers on an individual basis.

Restaurants can know exactly what items customers purchase and how frequently they purchase them, allowing the program to pivot between reinforcing existing purchasing habits and incentivizing loyal customers to try something new. And therein lies the real power of next-generation restaurant loyalty programs.