11.30.2021

Mobile payments company Mr Yum has raised a $65 million USD Series A round, led by Tiger Global. This is the largest Australian Series A funding round for a female-led company, and the third-largest Series A in Australian history.

Investors in the round also include Commerce VC, VU Venture Partners and Skip Capital (the private fund of Atlassian co-founder Scott Farquhar and Kim Jackson). Existing investors TEN13 and AirTree also followed-on in this round, making their largest investments to date into the company. Other investors in Mr Yum include US-based Australian NBA star Patty Mills of the San Antonio Spurs and Grammy Award winning artists Rüfüs Du Sol.

The Series A follows Mr Yum’s $8 million Post-Seed round in April 2021, bringing the total funding raised to date by the company to $73 million ($100M AUD).

Launching in the US in 2021, Mr Yum has been adopted in some of LA’s leading venues, including E.P. & L.P and Strings of Life, as well as shows including Magic Mike Live Las Vegas and casinos such as Sahara Las Vegas.

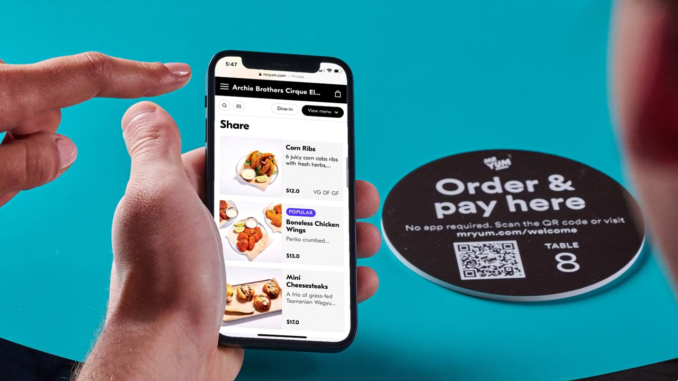

Founded in Melbourne, Australia, in November 2018, in just three years Mr Yum has become a global-leading mobile ordering, payments and growth platform with a mission to create the best growth toolkit for hospitality and entertainment in the world.

This toolkit is more than just QR code ordering, but encompasses a suite of features for operators, including payments, loyalty, marketing and customer insights.

Mr Yum CEO and co-founder Kim Teo says the funding round will accelerate the company’s global growth and help cement the post-pandemic recovery and trajectory of the hospitality and entertainment industries around the world.

“We couldn’t be more excited about the new partners that have joined our crusade. This round of capital allows us to triple down on our global lead on product innovation as we grow our teams across the US, the UK and Australia,” she says.

“Restaurants are embracing technology more than ever and our focus is building best-in-class tools to help them grow, in the same way Shopify has for retail.”

Tiger Global partner John Curtius says the company is thrilled to lead the Series A round to support Mr Yum to continue scaling globally.

“Tiger Global is heavily invested in restaurant technology around the world. We understand the category and players well and Mr Yum is the clear leader in product innovation for mobile ordering and payments,” he says.

AirTree partner James Cameron says it’s rare to see consumers adopt a new behaviour as quickly as they have with Mr Yum’s products.

“Their QR codes have now become ubiquitous in Australia, and it’s happened pretty much overnight. With this new funding they are able to double down on their international markets, where they are already growing faster than they were in Australia,” he says.

Mr Yum led the way with web-first mobile ordering and popularised QR codes in a Western dine-in context long before the pandemic ushered in the mainstream adoption of their use.

As a first-mover, Mr Yum has now become the category leader for mobile ordering, payments and growth tools and has been adopted in all types of venues, including casinos, theatres, shopping centres, cinemas, cruise ships and airports as well as restaurants, bars, pubs and cafes.

The company has grown from 12 to more than 120 full-time staff in the past 18 months, with teams in Los Angeles, London, Sydney, Brisbane and the Melbourne headquarters.

Mr Yum was named 4th in LinkedIn Australia’s 2021 Top Startups List, an annual ranking of the best emerging companies to work for – globally.

Mr Yum has 13 million users and more than 1500 venues on the platform globally.

Does your company have news it would like to share with our readers? If so, we invite you to review our editorial guidelines and submit your press release for publishing consideration.