11.13.2019

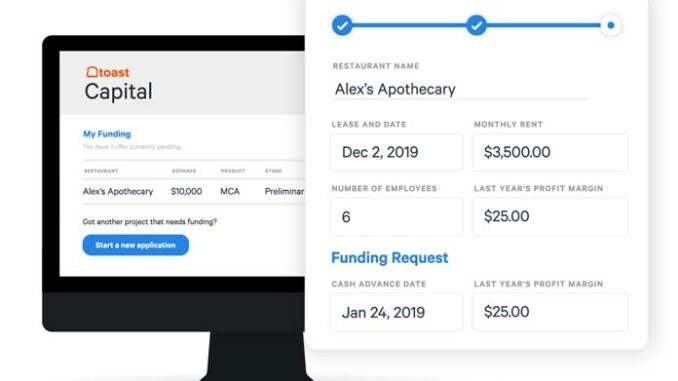

Restaurant management solution provider Toast today unveiled Toast Capital: a solution designed from the ground up to provide restaurants of all sizes with access to fast, simple, flexible funding to cover working capital needs and invest in their growth.

Nearly 52 percent of restaurant professionals rank high food and operating costs as a top challenge in running a restaurant, according to the Toast Restaurant Success in 2019 Industry Report. Access to capital from brick and mortar financial institutions has historically been a challenge for restaurants due to perceived risks common within the restaurant industry, such as seasonality and thin profit margins.

Nearly 52 percent of restaurant professionals rank high food and operating costs as a top challenge in running a restaurant, according to the Toast Restaurant Success in 2019 Industry Report. Access to capital from brick and mortar financial institutions has historically been a challenge for restaurants due to perceived risks common within the restaurant industry, such as seasonality and thin profit margins.

Based on Toast’s deep experience in serving the restaurant community, Toast Capital simplifies life for restaurateurs and provides them with quick and reliable access to funding to help grow their business. Benefits include:

- Fast, flexible funding: Toast Capital Loans provide easy access to the financing restaurants need, when they need it. Members of the Toast Restaurant Community can apply in just a few minutes and, once approved, receive funds as soon as one business day.

- An eligibility engine designed for restaurants: Eligibility for a Toast Capital Loan is determined by a number of attributes, such as sales history, time in business, and time as a Toast customer. Unlike traditional business loans, Toast Capital Loan eligibility guidelines take into consideration specific industry challenges, such as seasonality.

- One fixed, transparent cost: Toast Capital Loans offer funding at a fixed cost that is tailored to each restaurant. Toast Capital Loans have no compounding interest or personal guarantees. Funding is available between $5,000 and $250,000, based on eligibility.

- Simple, automated repayments: Toast Capital Loans are repaid as a fixed percentage of daily credit card sales. This means repayment flexes with restaurant sales volume so when sales are slower, restaurants repay less than on busy days.

“Since investing in Juvia and Sushi Garage with Toast Capital seven months ago, our revenue increased by over 15 percent,” said Tim Sandoz, director of operations at Juvia Group in Miami, Florida. “Funding through Toast Capital allowed us to expand our dining space and increase the number of covers we can handle each night. Historically, reservations would book up four days in advance, which meant a lot of disappointed potential diners. Since the expansion with Toast Capital, we now have additional seating which allows us to accommodate more guests, grow our revenue, and increase server tips.”*

“Toast Capital is a restaurant-first funding partner committed to the success of the Restaurant Community,” said Tim Barash, chief business officer, Toast. “We understand the unique challenges restaurant owners face when it comes to running a business and securing a loan. That’s why a Toast Capital Loan provides access to transparent financing with one flat fee, empowering restaurant owners to do what they love and thrive.”

Does your company have news it would like to share with our readers? If so, we invite you to review our editorial guidelines and submit your press release for publishing consideration.